Condo Insurance in and around Kingwood

Condo unitowners of Kingwood, State Farm has you covered.

Condo insurance that helps you check all the boxes

Home Is Where Your Condo Is

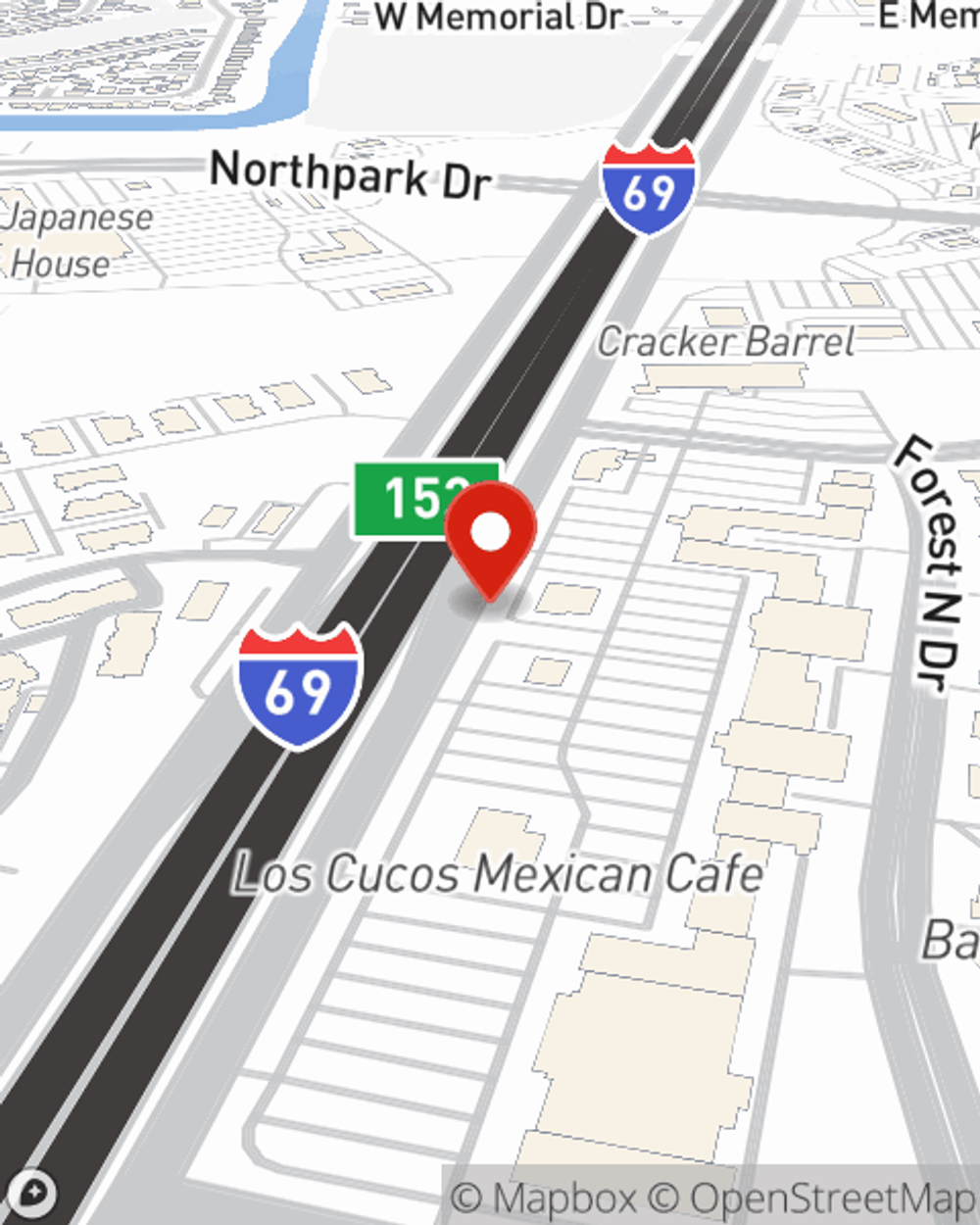

There are plenty of choices for condo unitowners insurance in Kingwood. Sorting through providers and coverage options isn’t easy. But if you want great priced condo unitowners insurance, choose State Farm for covering your condo and personal belongings. Your friends and neighbors in Kingwood enjoy impressive value and no-nonsense service by working with State Farm Agent Brian Burklow. That’s because Brian Burklow can walk you through the whole insurance process, step by step, to help ensure you have coverage for your condo as well as sports equipment, clothing, jewelry, furniture, and more!

Condo unitowners of Kingwood, State Farm has you covered.

Condo insurance that helps you check all the boxes

Safeguard Your Greatest Asset

Everyone knows having condominium unitowners insurance is essential in case of a hailstorm, ice storm or fire. The right amount of condo unitowners insurance can cover the cost of reconstruction, so you aren’t left with the bill for a home you can’t live in. Another valuable component of condo unitowners insurance is its ability to protect you in certain legal situations. If someone has an accident in your home, you could be on the hook for their medical bills or the cost of their recovery. With adequate condo coverage, you have liability protection in the event of a covered claim.

Intrigued? Agent Brian Burklow can help outline your options so you can choose the right level of coverage. Simply call or email today to get started!

Have More Questions About Condo Unitowners Insurance?

Call Brian at (281) 354-1210 or visit our FAQ page.

Simple Insights®

Personal property and casualty insurance

Personal property and casualty insurance

What is Personal Property and Casualty Insurance? Learn more information on automobile, homeowners, watercraft, condo, renters and more.

Should I pay off my mortgage before I retire?

Should I pay off my mortgage before I retire?

Retiring without mortgage payments could mean less debt and monetary worries in your retirement years. Here are a few tips to help.

Brian Burklow

State Farm® Insurance AgentSimple Insights®

Personal property and casualty insurance

Personal property and casualty insurance

What is Personal Property and Casualty Insurance? Learn more information on automobile, homeowners, watercraft, condo, renters and more.

Should I pay off my mortgage before I retire?

Should I pay off my mortgage before I retire?

Retiring without mortgage payments could mean less debt and monetary worries in your retirement years. Here are a few tips to help.